On October 20th, China Tower released its three-quarter report. In the first three quarters of 2020, China Tower achieved operating income of 60.220 billion yuan, an increase of 5.6% year-on-year, of which cross-industry and energy business revenue reached 2.612 billion yuan, an increase of 92.8% year-on-year. Rapid growth trend; profit attributable to the company’s shareholders was 4.564 billion yuan, a year-on-year increase of 17.8%. In the first three quarters of the China Tower, a total of 345,000 5G sites were built, and over 97% of them were completed by sharing existing site resources. Some analysts believe that with the increase in the rental rate of 5G base stations between the tower company and the three major operators, the tower business revenue brought by 5G is expected to accelerate growth.

Under the general trend of 5G base station construction, the purchase of lithium iron phosphate batteries for backup power has become a considerable expenditure for tower operators. In fact, as the power consumption of 5G base stations increases significantly, using backup power to cut peaks and fill valleys will reduce electricity costs and become a standard function of 5G base stations. Compared with traditional lead-acid batteries, lithium iron phosphate batteries will be a better choice. Therefore, 5G will be officially commercialized in 2019, and the pace of construction is now further accelerated. And behind the acceleration of 5G construction, lithium batteries have become a new blue ocean market.

The East Securities Research Group pointed out in a report on the lithium iron phosphate industry chain, “With the continuous decline in the cost of lithium batteries, the market price of lithium iron phosphate batteries for energy storage has dropped to 0.68 yuan/Wh. Considering the impact of peak shaving and valley filling, the life-cycle cost of lithium batteries on 5G base stations also far exceeds that of lead-acid batteries.” The report pointed out that after testing, the new lithium batteries of each 5G base station can complete two complete cycles per day. Peak-to-valley switching saves 10,400 yuan and 2,554 yuan in electricity bills per year compared with lead-acid batteries. Based on the 7.6 million 5G base stations in 2025, it can save 19.4 billion yuan in electricity bills every year.

Therefore, China Mobile will purchase about 1.95GWh of lithium iron phosphate battery products for communications at a maximum price of over 2.5 billion yuan in 2020. In the end, eight companies won the bid, namely: Zhongtian Technology, Haistar, Shuangdeng Group, and Yiwei Lithium Energy, Narada Power, Vision Power, Coslight Power, Lilang Battery, the lowest bid price is about 0.661 yuan/Wh, and the winning bid is 1.368 billion yuan. China Tower also issued a tender for the centralized procurement of 2.0GWh lithium iron phosphate batteries for backup power in 2020. In the end, Shuangdeng Group, Narada Power, Penghui Energy, Zhongtian Technology, and Shengyang Power won the bid.

Recently, China Tower and China Telecom respectively issued an announcement on the normalization test of spare lithium iron phosphate batteries, requiring that the supplier to be inspected should be a manufacturer of lithium iron phosphate battery packs, and have independent production capacity of lithium iron phosphate batteries, and send samples The model is lithium iron phosphate battery pack (integrated) with 48V/100Ah backup power. The "Implementation Rules for Lithium Iron Phosphate Battery Testing" requires samples of 5 battery packs, 1 BMS and 9 single cells, and lithium iron phosphate for backup power The battery detection is divided into three parts: system, BMS and platform access. In terms of safety performance, the battery should not fire or explode under the conditions of resistance to overcharge, deep discharge, impact resistance, high temperature resistance, and short circuit resistance.

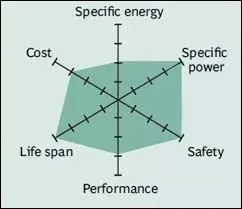

Lithium iron phosphate batteries have a longer life than lead-acid batteries. "The cycle life of a lead-acid battery is 3-5 years, and the number of charging and discharging is 500-600, while the life of a lithium iron phosphate battery is more than 10 years, and the number of charging and discharging exceeds 3000, which means that the lithium iron phosphate battery can be better Covers the entire life cycle of 5G base stations." "The logic of lithium iron recycling has been verified in power batteries. In the 5G era, lithium iron batteries will play a greater role in the energy storage of communication base stations."

The article from China Powder News